Letting the Personal, Not the Potential, Lead the Way

Wealth means something different to everyone. The journey to financial freedom through short-term rentals is best traveled when the end directs the means. New hosts have the important opportunity to truly begin at the beginning. To dream big, but to dream big in their own language of what long-term financial success and personal freedom mean.

Every great Airbnb strategy begins with an audit of a host’s personal intentions. For one host, an incredible outcome might be a full-scale, multi-property portfolio that could employ a small team and become the investor’s major focus. For another, having a rental property for the taking that can earn its cost through occasional rentals might be the dream.

Investors are taught to consider the potential of a venture, a stock purchase, or an acquisition. But for rental property investment, the potential needs to be informed by the investor’s personal priorities. Following are a few questions, considerations, and exercises to model the process.

If Home Is Where the Heart Is…

The first thing to consider for hosts and investors is whether they’d like to use their property for personal use with the financial benefits that renting could bring or if this property is strictly a financial investment.

That may open up location, home type, and several other attributes to more options. Acquiring a dream property in a desirable location where one might have family, friends, or an interest in the local culture, and loaning out that property when it’s not in use, is one business model.

Doing the math for a property that’s solely for guest use, and positioning it in the market with the highest trends in occupancies and stay rates, is a wholly different approach.

What does your personal conception of freedom, in this sense, look like? The freedom to travel back to one place with free accommodations and flexibility of schedule, or the financial freedom from an investment property to go anywhere you want in the world? That integral question will have important ramifications for all things location — it’s important to begin here in the spirit of exploration.

A Big-Picture Investment Landscape

Similarly, property acquisition is best considered in the context of a wider investment portfolio. Personal investors can take stock of their approach as it stands.

What does this investment signify within a holistic portfolio? Is this an asset that’s meant to hedge against inflation, earn quick returns, diversify existing holdings, or some combination of all of the above? What kind of income needs to be liquid, through monthly rental earnings, and how much capital can be allocated to the property itself?

Traditionally, real estate has been the highest performing asset class. The risk-to-reward ratio is unparalleled. Short-term rentals improve further on that, offering hosts a low-risk asset without the illiquidity that’s generally involved in investments that don’t generate the same kind of monthly returns.

For both novice and established investors, a portfolio is a delicate ecosystem, and investing in a vacation rental is best considered in the context of existing investments.

Choosing Time or Team: The Difference Between Hands-On or Hired Property Management

Another crucial question to encounter at the inception of a short-term rental strategy is a host’s desired involvement. A self-managed property is a wholly different operation than a property for which the daily and monthly needs are abstracted through third-party partners.

Hands-on hosts will notice some distinct benefits. First, the cost of property management will certainly be lower, creating better margins on monthly returns. Hands-on hosts might enjoy a closer relationship with their guests. They may also feel more in control of the property design, cleanliness, and ambiance that defines the experience they’re offering to their guests.

Property management here is an experiential endeavor, instead of a hiring initiative. But as is always the case in the world of investments, there are pros and cons of hands-on hosting.

On-the-ground property management can have a profound effect on an investor’s time, mental space, and general stress. Guest problems are sure to arise. A guest is locked out in the middle of your child’s Saturday soccer game, or a pipe bursts just as you’re sitting down to family dinner.

Without a management partnership, guests’ needs have to come first. If a portfolio extends beyond a single property, the hands-on upkeep can easily add up to a part- or full-time job. Hosts who go it alone should be sure that’s a role they want to take on.

Alternatively, passing along the property’s needs to trusted third-party partners means the property is operating more as a passive investment.

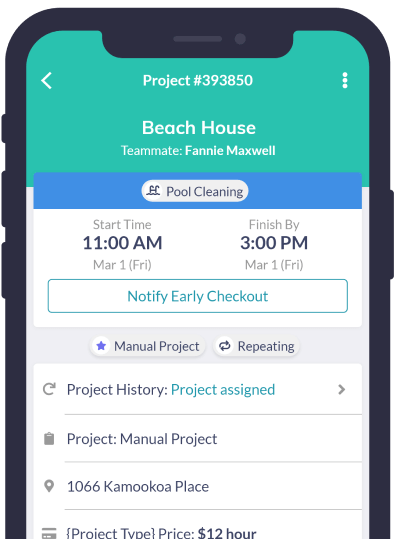

New-to-market solutions can integrate almost all of the property’s needs into one cloud-based workflow, with tech-heavy solutions for each need.

The cleaning and maintenance needs can be adaptively staffed for, the marketing and listing strategies can be automatically optimized for algorithmic patterns in market demand, and most guest communications can be similarly streamlined.

This strategy might result in higher upfront costs and some increased planning in the beginning stages. But it frees hosts and investors from being physically and time-bound to their property location.

Time, Money, And Mental Energy as Budget Items

Before engaging in property appraisals and financial models, it’s important that hosts consider the following questions. Would they like to purchase a turnkey Airbnb? Or, would they prefer to convert and capture the upside value of converting an existing rental into an operable property.

The latter strategy offers greater yields but also involves significantly more time and effort; each of which should be included in the financial models as significant line items.

This question again harkens back to the initial question of wealth and freedom as envisioned by the individual host. How much time do you have to spend? Do you have the appetite to be hands-on in experimenting and maintaining a new rental? Or, do you want to pay the cost to acquire a turnkey property with established success?

As long as those answers originate from and align with personal goals, the host will be on the right track to creating their dream rental business.

Wisdom is the backbone of all great investment endeavors. Wise decisions happen when a personalized plan meets a fail-safe execution. By beginning with a personal audit, investors will have the opportunity to be clear on their desired results beyond financial figures — how much time, thought, and effort does an ideal property occupy? How does it factor into an investor’s existing portfolio, or into a family’s desire for travel?

Wherever the needle falls on the aforementioned questions, the next part of the path becomes clear — the path that will lead the investor to their own tailored end destination.