Does a Cleaning Company Need Insurance?

There are many reasons why a cleaning company should have insurance. There is the risk of injury to employees, damage to property, and liability for injuries caused by the business. Insurance for a cleaning business helps protect you from these risks.

The type of insurance coverage you get will depend on what kind of cleaning company you have. This could be commercial or residential, for example. It is important to research which type of insurance will best suit your needs and budget.

What Do Cleaning Insurance and Bonds Cover?

Insurance for a cleaning business can cover a lot more than a bond. However, to have a legal and liable cleaning business, it is important to be insured and bonded.

Cleaning insurance covers incidents like on-the-job injuries or property damage. This can be helpful as it provides financial security to your cleaning business. Common cleaning business insurance will reimburse your business for any losses due to claims filed.

Bonds for a cleaning business mean you bought a bond to protect your business. In most cases, bonds are there to reimburse your clients in the event of property stolen. The bonds are there to protect your clients, not your cleaning business.

Cleaning Business Insurance Costs

Cleaning business insurance costs can go from $500 – $1,000 per year for a singular policy. Monthly and annual costs of general liability insurance vary based on your cleaning business. Some policies cost more than others.

The annual estimated premium of common cleaning business insurance policies:

- General liability: $500 – $4,500

- Commercial property: $400 – $1,500

- Commercial auto: $1,900 – $4,400

- Worker’s compensation: $5,000 – $6,800

- Business Owners Policy (BOP): $2,300 – $5,100

What Affects the Price of Insurance Premium Quotes?

It includes, but is not limited to, these four factors:

- The size of your business: The more employees you have, the more coverage you need to obtain.

- The industry you are in: A commercial window cleaning business will require more coverage than a small janitorial company.

- Your location: Some U.S. states have different laws and regulations that require other policies.

- The amount of coverage you need: If your work is deemed high-risk, you might need more coverage than a less-risky industry.

Cleaning Business Insurance and Bonds Every Airbnb Cleaner Needs

A cleaning company insurance policy can be customized to suit the needs of your business. Choose from various coverage options — even if you are a self-employed cleaner.

General Liability Insurance

Cleaning businesses are at a higher risk of liability. General liability insurance is tailored to these risks.

As the most important coverage for small cleaning businesses, general liability insurance covers third-party liabilities such as:

- Third-party property damage: If you damage or destroy an object or possession, such as a vase or a painting, you could be sued for property damage.

- Third-party bodily injury: If someone slips on a freshly waxed floor or has an allergic reaction to cleaning chemicals, you could be sued. However, only non-employees are covered here. Workers’ compensation covers medical bills for injuries or illnesses that your employees may acquire on the job.

- Personal and advertising injury: Competitors and third parties could sue you for defamation or copyright infringement.

In addition to protection against lawsuits and court costs, general liability insurance can also increase your chances of getting hired. Property managers and homeowners are more inclined to hire cleaners with these credentials than those without.

Workers’ Compensation Insurance

Workers’ compensation covers bills associated with medical treatments required for work-related injuries. It also covers the wages of the person being treated while out of work.

The cost of workers’ comp insurance premiums is based on the following:

- Payroll

- Location

- Number of employees

- Industry and risk factors

- Coverage limits

- Claims history

Insurers calculate workers’ compensation premiums through variated formulas. Their calculations can be very different from company to company. Even more, these formulas depend on the workers’ compensation laws in each state.

Guarantee that you find the best price for your cleaning business by requesting quotes from multiple workers’ compensation insurance providers. Independent agencies or brokers can assess the options and offer you the most competitive rates available for your cleaning company.

Lastly, sole proprietors, independent contractors, self-employed workers, and partners are not required to get workers’ compensation. However, they may choose to do so.

Fidelity Bonds

Also known as employee dishonesty bonds, fidelity bonds protect your clients from employee theft. Some clients won’t hire your company unless you have this coverage.

The most affordable fidelity bond for a cleaning business is a Janitorial Bond. It covers the same liabilities but at a cheaper rate.

Optional Types of Insurance for a Cleaning Business

Each cleaning service is unique. Acquire multiple types of cleaning insurance and bonds to aid in protecting your cleaning business. The more coverage you have, the less liability you owe.

Commercial Auto Insurance

Commercial auto insurance protects vehicles purchased by your business. It can also cover injuries and property damage in an accident, theft of a company vehicle, and certain types of vehicle damage.

Business Owner’s Policy

A business owner’s policy (BOP) is a cost-effective way for a cleaning business to purchase general liability insurance and commercial property insurance together. Small, low-risk cleaning businesses are usually eligible. Property insurance pays to replace or repair your insured gear when it’s lost or damaged because of:

- Fire

- Theft

- Vandalism

- Certain weather events

You can purchase property insurance on its own. Still, because you own a small business, you may be able to bundle your property and general liability coverage together in a business owner’s policy. This can help you save money on your premiums.

Commercial Umbrella Insurance

Cleaning businesses can purchase umbrella insurance to increase the policy limits on their general liability insurance, commercial auto insurance, and employer’s liability insurance.

Janitorial Bonds

Also known as employee dishonesty bonds, janitorial bonds protect your clients from employee theft. Some clients won’t hire your company unless you have this coverage.

Tips for Selecting a Cleaning Business Insurance Policy

Insureon’s Small Business State search tool will help you find insurance regulations in your state. To get started, choose your state and read through the list of steps to get quotes for general liability insurance.

Once you’re familiar with your state’s rules and requirements, conduct thorough research for at least five companies and policies. Some people prefer speaking with an insurance representative, while others prefer browsing websites. Whichever method is more comfortable for you, draw similarities between companies and take notes of their customer service.

Once you find an insurance company and policy that aligns with your business goals, confirm the policy and payment information. Lastly, be sure to keep in touch with your primary agent to oversee your insurance needs if they may change.

What Company Provides the Best Insurance for Cleaning Businesses?

Sifting through the many companies and insurance policies, you may be wondering what actual cleaning professionals use to insure their business. Experienced short-term rental and Airbnb cleaners favor the following companies for general liability insurance:

Frequently Asked Questions About Cleaning Business Insurance

Do I need insurance before I start my cleaning business?

We recommend setting up cleaning business insurance coverage before starting the operation of your business if possible. This will ensure your employees, cleaning supplies and equipment, personal property, and customers have financial protection from day one.

Securing insurance before starting your business can also be helpful in gaining new clients. Being able to tell potential customers that your business is insured — and preferably licensed and bonded, too — will help build trust and a positive reputation.

What type of van insurance is best for your cleaning business?

Cleaning business vans or other vehicles are high-risk for theft and damage. The most common types of insurance that a cleaning company vehicle may need are commercial vehicle insurance, commercial auto liability, commercial auto physical damage, and workers’ compensation.

Commercial vehicle insurance will protect your company from liability if someone is injured or property is damaged by your vehicle. Commercial auto liability will cover the costs of any damages done by your employees in the course of their work duties.

Commercial auto physical damage will cover repairs to your vehicle in the event that it gets damaged in an accident or other incident on the road. Lastly, workers’ compensation covers physical injuries to workers in the event that they get hurt on the job.

What does bonded mean for a cleaning company?

Bonded cleaning companies are required by law to have insurance. This is because they need to pay a bond to the state government. The bond acts as a security deposit for their customers. If the cleaning service does not fulfill its obligations, then the state will take over and make sure that the customer gets compensated for any damages or losses incurred.

How much does cleaning service business insurance and bonding cost?

According to Insureon, cleaning businesses can get general liability insurance coverage for a median premium of under $45 per month.

That said, it’s often recommended for cleaning businesses to obtain a BOP instead of solely general liability coverage. A BOP typically costs cleaning businesses a median premium of around $43 per month.

Janitorial bonds cost less than $8 per month, in most cases.

Your Cleaning Business Is Insured… Now What?

Now that you know the basic types of insurance for your small cleaning company, you can take steps to get insured and protect yourself, your business, and your equipment.

There are countless other to-dos to keep in mind, however, when starting or scaling a cleaning business. Some of the most important tasks to grow a cleaning service include reaching new customers and organizing your workflows.

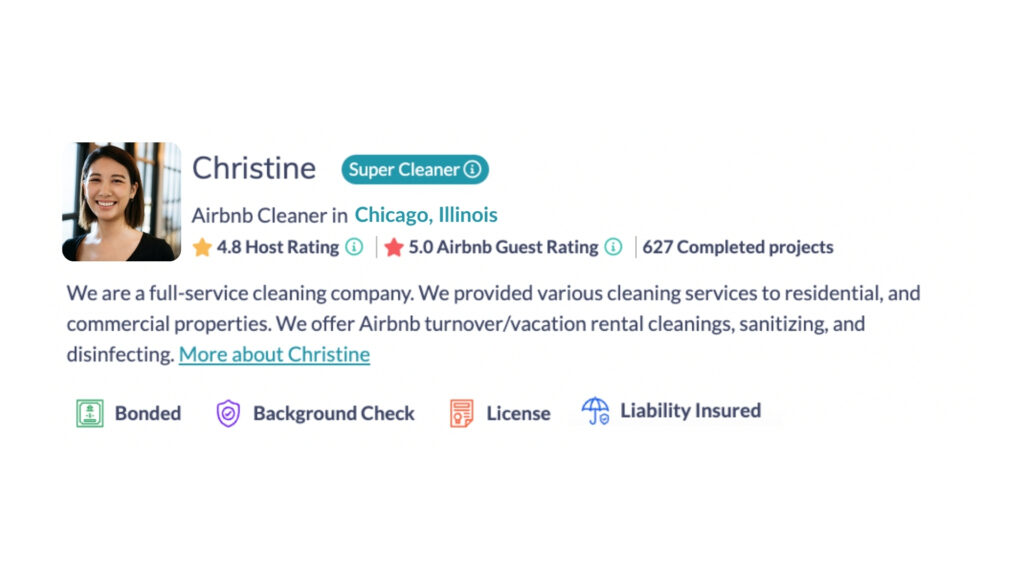

In cleaner marketplaces like Turno, you can stand out amongst your competitors by showing proof of insurance, bonding, and licensing in the form of “badges” displayed on your cleaner profile.

View our other resources for cleaning business owners to help your cleaning company thrive.