Short-Term Rental Insurance Is a Must

For short-term rental owners, in particular, landlord insurance is not a fringe benefit — it’s a necessity. The possibility of property damage and injury only increases when multiple people are coming and going from your property. You want to protect your assets and reduce your liability risk.

While securing traditional property insurance may be easy, getting short-term rental insurance is often more challenging — and costly — for a few reasons. Some of these include:

- Heightened risk for submitted claims

- Higher risk of prolonged vacancy based on seasonality

- Increased personal property coverage requirements (considering short-term rentals are typically furnished)

With these added risks, it’s unsurprising that the cost of short-term rental insurance tends to be 20% to 30% higher than other property insurance. That said, it’s a crucial investing strategy to secure short-term rental property insurance to protect your asset and have proof of insurance at closing.

The key to securing cost-effective, short-term rental insurance? Partner with a reliable broker or carrier to find the right coverage at the right price.

A trustworthy partner like Azibo can help you weigh different coverage options, gain insight into state-specific requirements, and make decisions that align with your budget and financial goals. Among the most well-known and reputable short-term rental carriers are CBIZ and Proper Insurance — and an effective partner can help you determine your best fit.

Hosts should also consider creating renter guidelines and house rules to set expectations early on with tenants. This may help mitigate risk, prevent damage, and minimize complaints from neighbors.

Financing a Short-Term Rental May Come With Prepayment Penalties

Maybe you’ve evaluated your budget, calculated anticipated rental income, and set aside more than enough money for a down payment. Everything seems ready to go — until you find out that financing your short-term rental comes with prepayment penalties.

For these properties, in particular, lenders may charge a fee for paying off loans within several years of taking out a loan. Lenders often do this to dissuade borrowers from paying off their mortgage right away or refinancing, since it means less interest income on their end.

It’s important that investors do their research and account for prepayment penalties in advance. For example, if your lender has steeper penalties for prepayments in the first five years, you should know that up front.

You May Be Subject to Licensing Fees or Annual Fee Requirements

Depending on your state and municipality, your short-term rental property may be subject to licensing fees or annual fee requirements. Many hosts don’t factor this into their budget at first.

Be sure to check with the local municipality and state to account for additional fees specific to your short-term rental property. If you have multiple short-term rental properties across different states, consider how licensing fees or annual fee requirements may vary.

Short-Term Rentals Have Their Own Set of Property Ownership Costs

The cost of ownership for a short-term rental property is very different than the cost of ownership for a primary residence. Between property management, vacation platform fees, maintenance, and cleaning costs, short-term rental hosts have many additional expenses — and responsibilities — on their plate. These include:

Property Management and Vacation Platform Fees

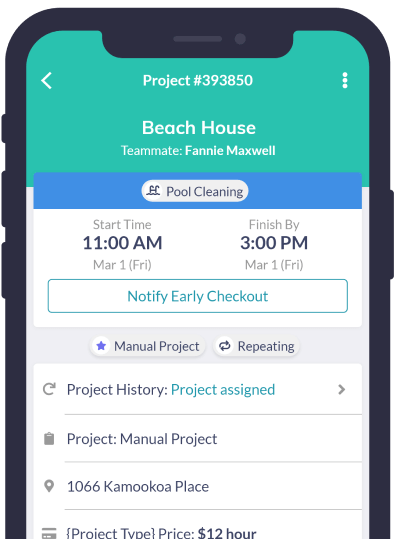

Many short-term rental property owners use property managers to handle the day-to-day responsibilities of property ownership, like creating online listings, booking guests, coordinating check-ins, collecting rent, and managing maintenance.

If you’re using a vacation rental management platform like Vacasa or Turnkey, you probably already have property management support. But if you’re using a bookings site like Airbnb or Vrbo, you may want to hire a reputable property manager.

That said, property management fees are much higher for short-term rentals because of the added risk. Keep in mind that platforms like Airbnb, Vacasa, and Vrbo have hosting fees that range from 3-5% of your gross revenue.

Repairs and Maintenance Costs

Similarly, the cost of repairs and maintenance rises significantly for short-term rental properties. As a host, be sure to budget at least twice as much money as you would for long-term rentals. It’s better to be financially prepared in the event of a broken washing machine or window because scenarios like this will happen more often than you expect.

In the same vein, many real estate investors underestimate the cost of utilities. While internet, electricity, gas, and water typically aren’t covered by long-term rental property owners, short-term rental property owners often pay for these expenses — and that means they must budget accordingly.

Cleaning Fees

Finally, a large part of short-term rental maintenance is making sure your property is clean and cared for when tenants arrive. For this reason, it’s important to budget the time and money it’s going to cost you to clean your property before the next tenant arrives.

You might consider a reliable, affordable cleaning service or opt to clean the property yourself. Either way, consider what your time is worth and what you can reasonably charge guests if you include a cleaning fee on top of your nightly rate.

Make the Most Out of Your Short-Term Rental Investment

Futurestay recommends that “in the same way that you wouldn’t want to finance a new car while a home loan is going through, beware of the temptation to use credit to outfit your new property with upgraded furniture and amenities.

Sure, you’ll want to do this before you list, but you’ll really want to take care of this with cash to ensure there are no inconsistencies for your lending officer to find as they work to process your loan.”